Creekhills Credit Union's Home Equity Line of Credit

Let the equity in your home work for you as hard as you worked to earn it!

With a Home Equity Line of Credit (HELOC) from Creekhills Credit Union, homeowners can tap into the available equity in their homes to finance a range of expenses such as home improvements and college tuition, refinance an existing higher-rate mortgage, or consolidate higher-interest debt.

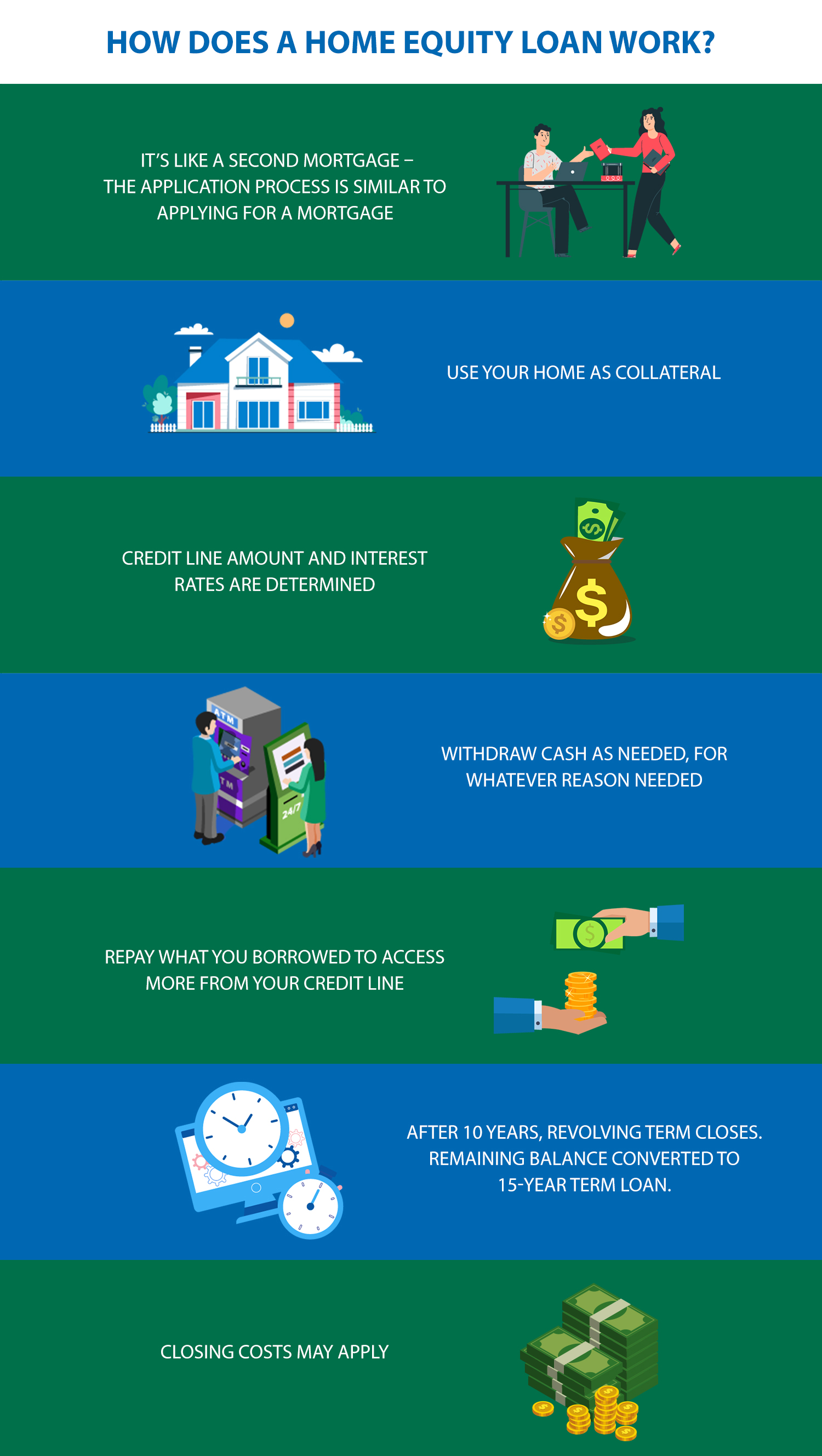

How do HELOCs work?

A HELOC is a revolving form of credit that uses your home as collateral. During the 10-year active period, you can withdraw money to use however you see fit. Once your HELOC reaches the end of its revolving term, any remaining balance will be repaid with a 15-year term loan.

A HELOC is a slightly more flexible option than a home equity loan.

What do Homeowners Use a HELOC for?

The simple answer is anything. With easy online access to your Home Equity Line of Credit and check writing privileges, you can use your HELOC like cash to make online payments or purchases, transfer funds into a linked deposit account, write checks to contractors for home renovations, pay a child’s school tuition, and more. Some people open a HELOC in case of an emergency and don’t use it right away. There is no obligation to withdraw funds from your HELOC and, with a lower interest rate than a credit card, it’s an attractive credit option.

Enjoy the Convenience of a HELOC from Creekhills Credit Union:

- Only pay for what you use on your line of credit.

- Intro rate of 1.99% APR1 for 6 months and then Prime -.10%. 2

- No Closing Costs on lines up to $150,000. 3

- Refinance existing Mortgages / Home Equity Loans.

- Set up account activity notifications through Online Banking.

- Available on properties in New York, New Jersey, Connecticut, Massachusetts, and Pennsylvania.

- Possible tax advantages. Consult with your tax advisor to determine eligibility.

Compare Home Equity Line of Credit Options

Principal & Interest

Pay down your HELOC balance with principal and interest payments from the start. This will mean larger minimum payments but a faster repayment period. This could be a good option for homeowners who don’t plan to use all of their available credit or to only use the HELOC in case of an emergency.

Interest-Only

Make interest-only payments for the first 5 years of your HELOC term. You still have the option to pay towards the principal balance any time you wish. This could be a good option when you use your HELOC to finance a big expense, like a home renovation, that will reach its full value upon completion (at which time you might refinance your mortgage and pay off the HELOC).